vermont sales tax exemption certificate

Companies or individuals who wish to make a qualifying purchase tax-free must have a Vermont state sales tax exemption certificate which can be obtained from the Vermont Department of. Exemption certificates are not filed with the Vermont Department of.

Nonprofits Raising Funds With Online Thrift Stores Charity Work Ideas Unique Fundraisers Nonprofit Fundraising

Integrate Vertex seamlessly to the systems you already use.

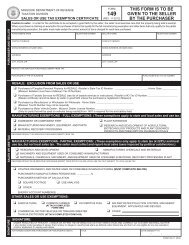

. Vermont Sales Tax Exemption Certificate for Form PURCHASES FOR RESALE AND BY EXEMPT ORGANIZATIONS 32 VIS-A. The sales tax license or permit numbers there enumerated and that all the tangible personal property purchased from. State of Vermont Attached is a copy of the Resale and Exempt Organization Certificate of Exemption for the state of Vermont.

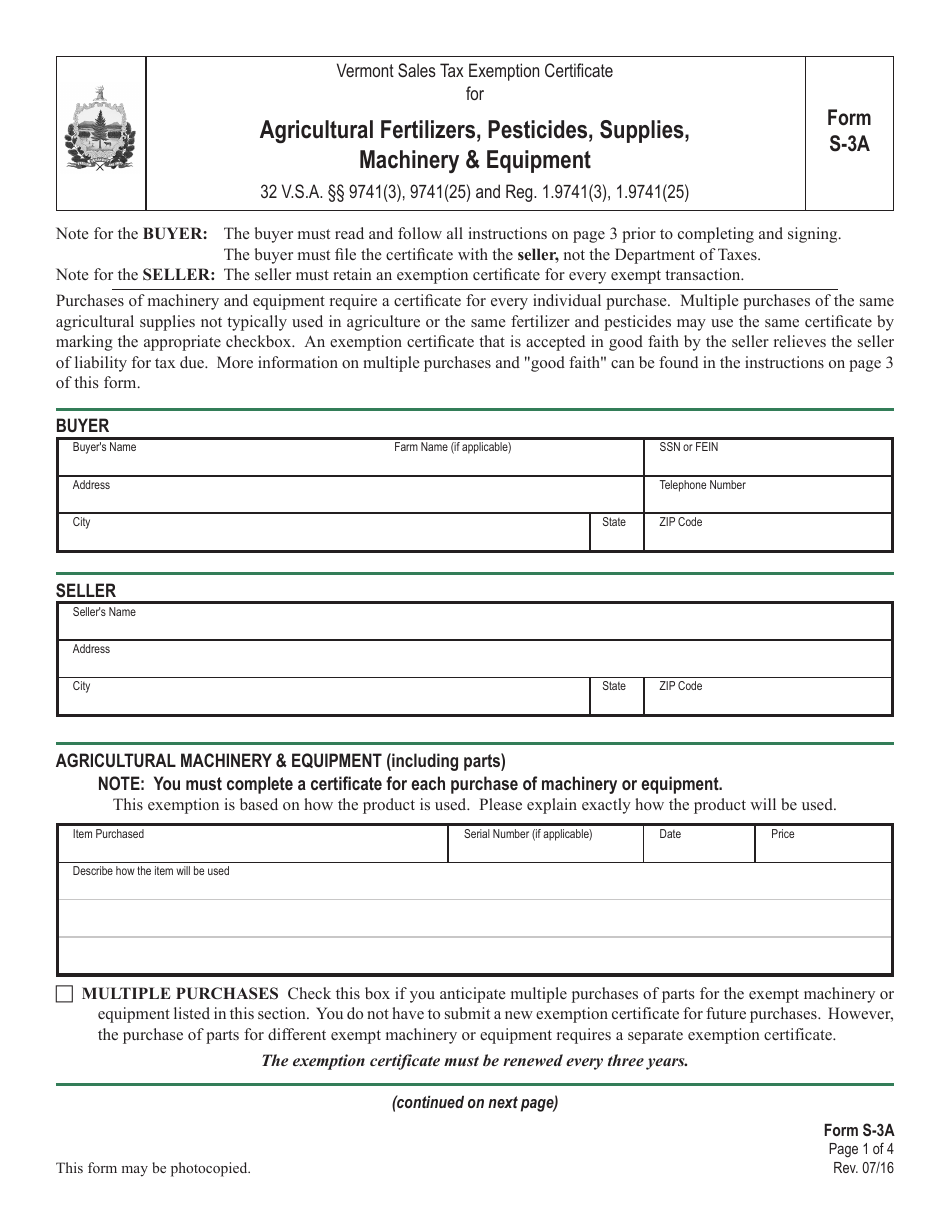

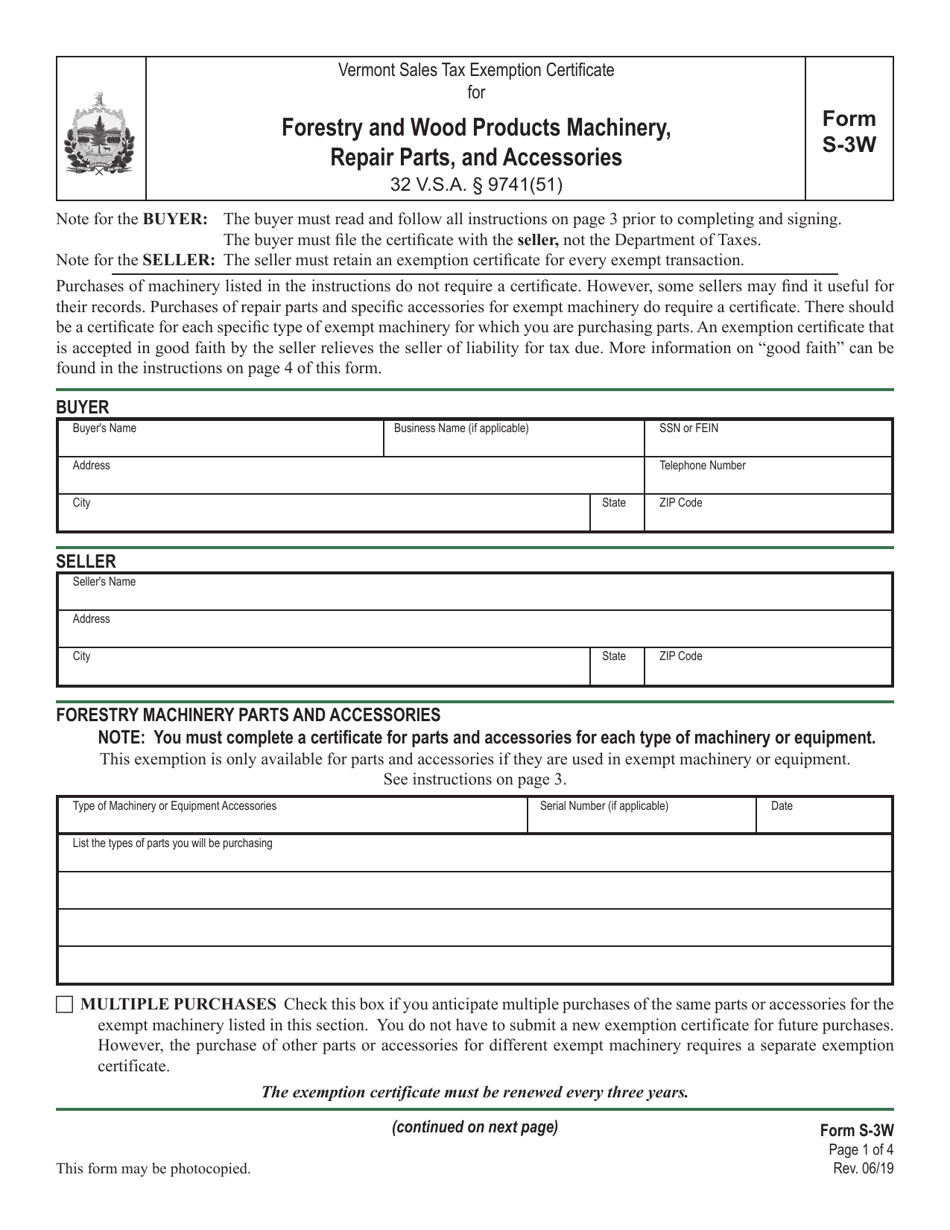

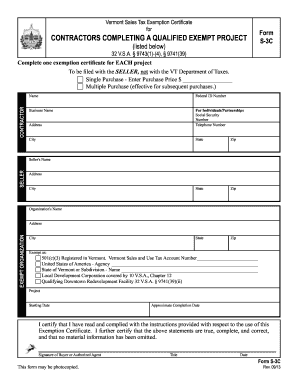

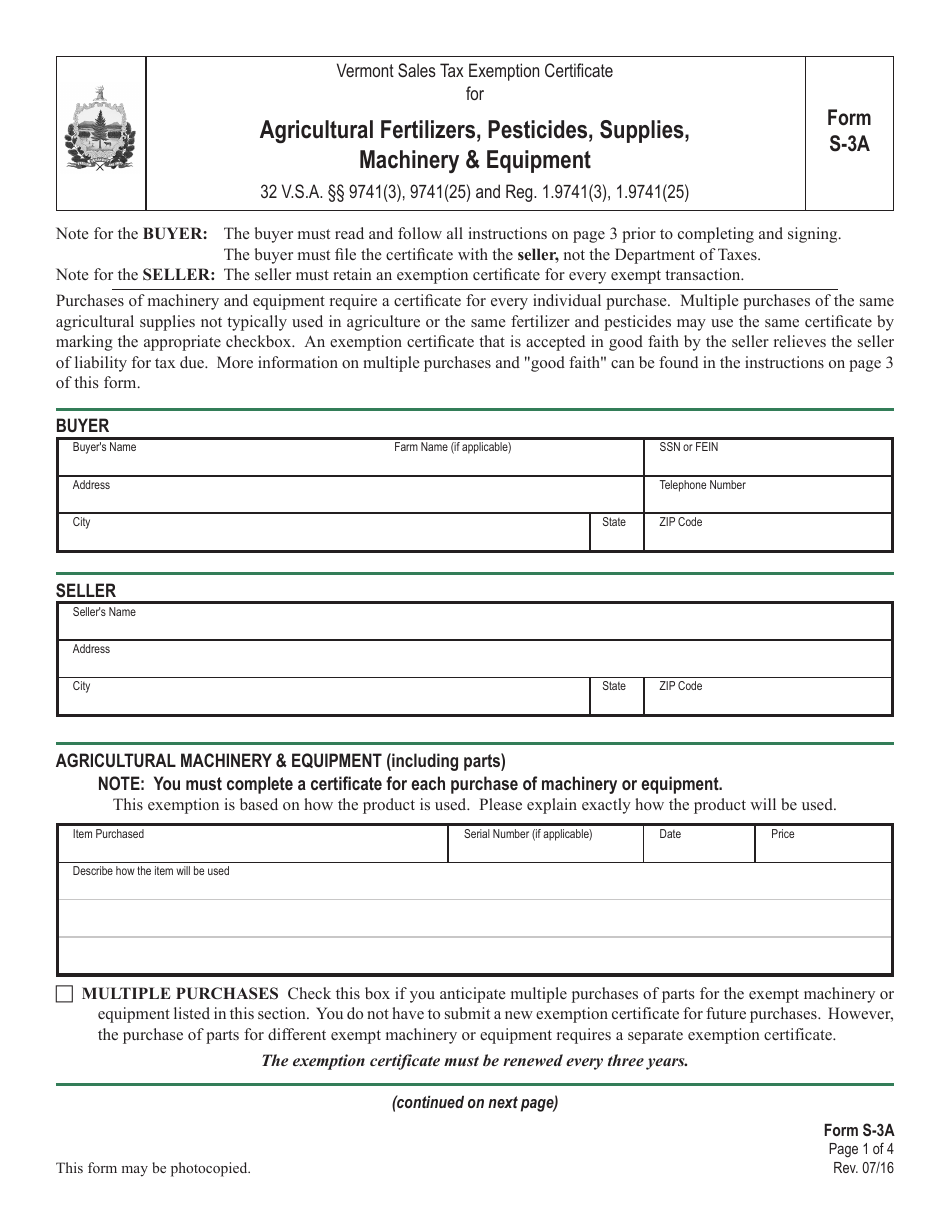

Erly executed exemption certificates shall be deemed to be taxable retail sales. 9741 3 9741 25 Form S3A To be filed with the. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax.

S-3F Vermont Sales Tax Exemption Certificate For Fuel. Tax Exemption Certificate Form Simple Online Application. S-3pdf 8943 KB File Format.

The exemption certificate the sales slip or invoice must show the buyers name and address sufficient to link the purchase to the exemption certificate on file. Good Faith - In general a vendor who accepts an exemption certificate in good faith is relieved of liability for collection. Ad Tax Exemption Certificate Form Wholesale License Reseller Permit Businesses Registration.

53 rows Exempt from sales tax on purchases of tangible personal property and meals not rooms. How to use sales tax exemption certificates in Vermont. 503 ˇ ˆ.

The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES MACHINERY EQUIPMENT 32 VSA. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. The burden of proof that the tax was not required to be collected is upon the SELLER. 45 rows Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems.

To obtain exemption from sales taxes this form must be. 97431-3 ˇ. Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5.

A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the. Without it correctly filled out the seller could end. Other types of exemption.

9701 To be filed with the SELLER not with the VT. If audited the Vermont Department of Taxes requires the seller to have a correctly filled out Form S-3 Certificate of Exemption. Vermont Sales Tax Exemption Certificate for Form RESALE AND EXEMPT ORGANIZATIONS 32 VSA.

Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. You can download a PDF. You can download a PDF.

Blanket Resale Exemption Certificate for all states except New York. Ad Download or Email MTC Sales Tax Cert More Fillable Forms Register and Subscribe Now. INSTRUCTIONS FOR USE OF EXEMPT USE CERTIFICATES - ST-4 1.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax.

Fillable Online Vermont Sales Tax Exemption Certificate For Form Resale Fax Email Print Pdffiller

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S

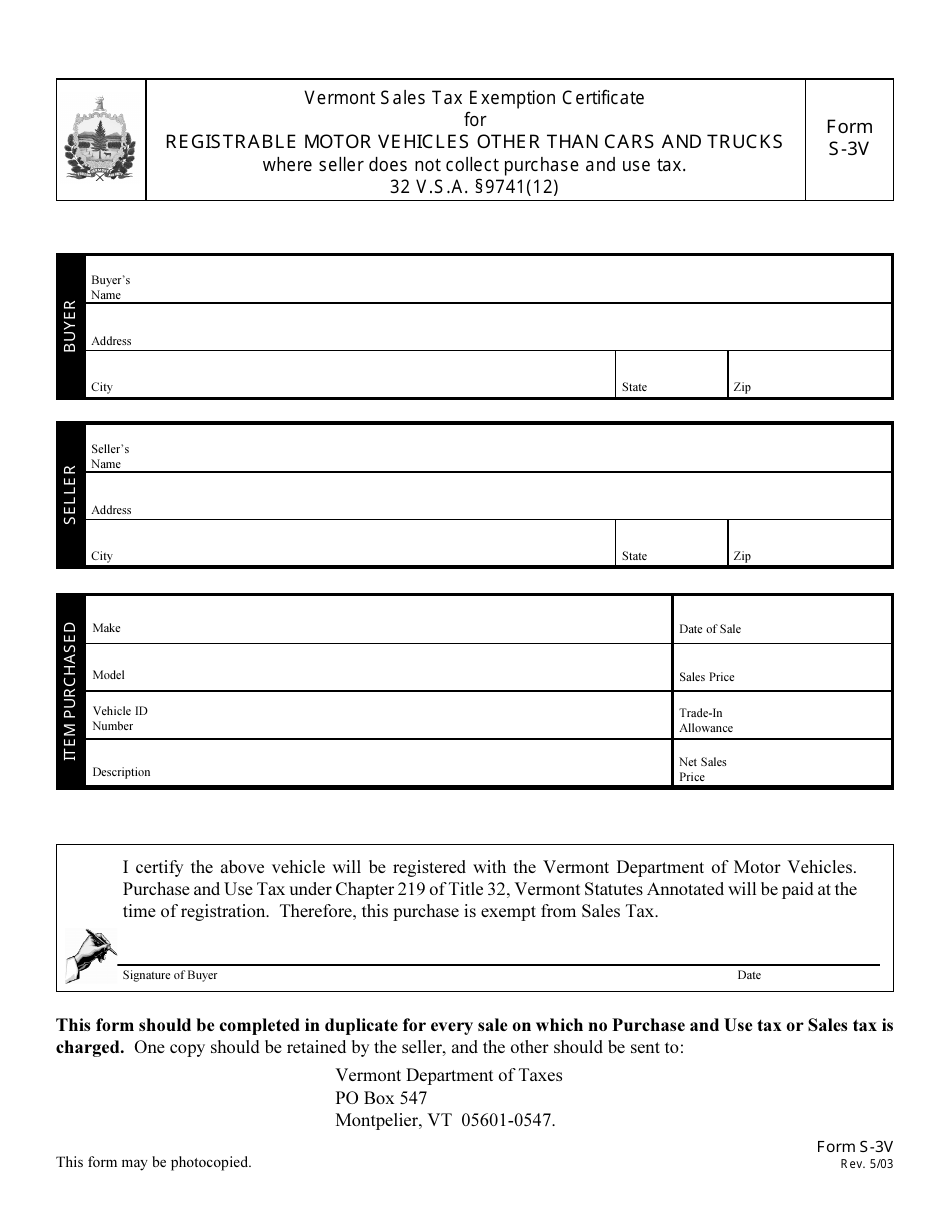

Form S 3v Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Registrable Motor Vehicles Other Than Cars And Trucks Vermont Templateroller

Setting Up Sales Tax In Quickbooks Online

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Form S 3 Vermont Sales Tax Exemption Certificate For Purchases For Fax Email Print Pdffiller

Form S 3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

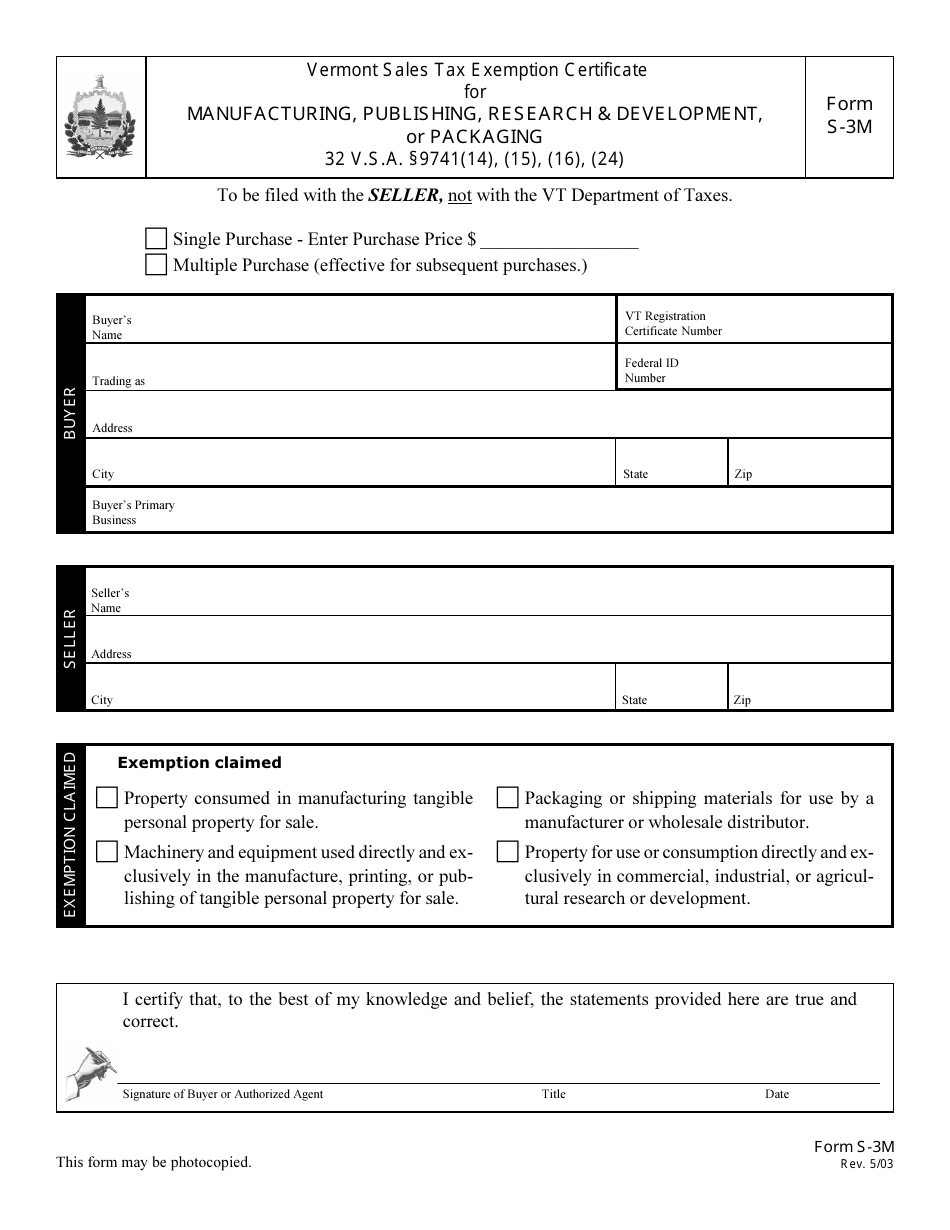

Vt Form S 3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

Printable Vermont Sales Tax Exemption Certificates

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

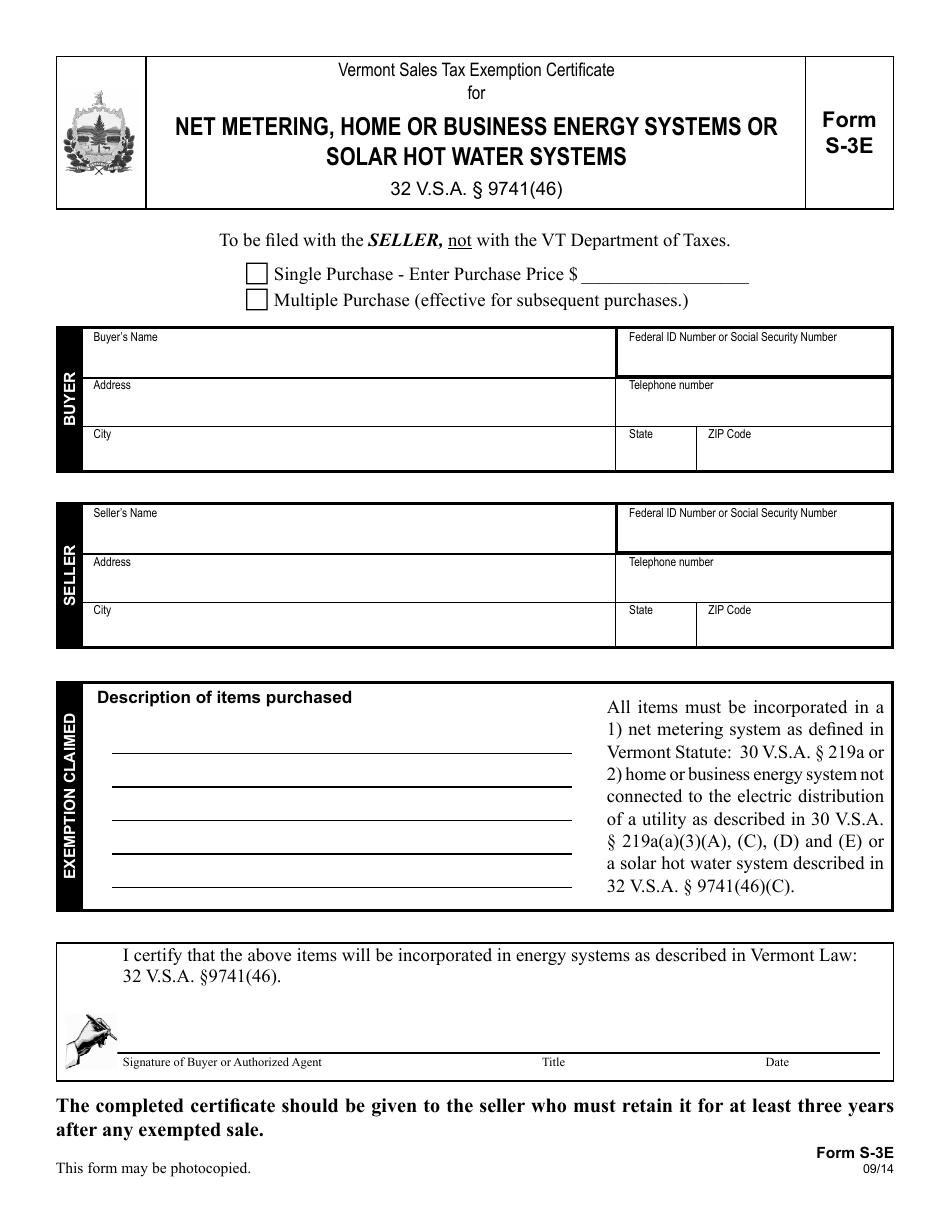

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S